07 5440 5794

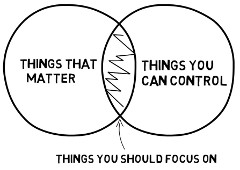

Do you want to know a secret? Building long-term wealth through investment doesn’t have to be complicated. And it doesn’t depend on making forecasts. The simple fact is that market returns are there for the taking, so long as you stay disciplined and build a diversified strategy around risks that carry a reliable reward. 31/7/2018

Top 10 investment tipsThe media would have you believe that a successful investment experience comes from picking stocks, timing your entry and exit points, making accurate predictions and outguessing the market.

Is there a better way? 10/7/2018

What's a million dollars get you?“A million bucks won’t get you much these days”.

I was taken aback by the comment. We tend to use that number to decide who is rich and who isn't. “Oh, he’s a millionaire, he can afford it”. 10/7/2018

Never make a killing, never get killedA great takeaway from one of my favourite money books, The Most Important Thing by Howard Marks is about understanding cycles. Here is how he explains it: “I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.”

The problem is that each cycle is different. So it’s very difficult to convince yourself that; a) The good times will eventually end OR b) The bad times won’t last forever. What this means is that we tend to sell after prices go down and we buy after a run-up in price. My all-time favourite Behaviour Gap sketch by Carl Richards sums it up beautifully: William Bernstein has several good reads, including the one I’ve just finished The Investor’s Manifesto, Preparing for Prosperity, Armageddon and Everything in Between. (yes, I was lured by the title)

For those that haven’t heard of William Bernstein, his status is legendary in financial circles. There’s a couple of things that I really like about him – 17/4/2018

The Espresso StrategyWhen you haven't got much capital of your own, the road to financial security can seem long and arduous. But the truth is that wealth building is actually pretty simple.

All it takes is time and the price of a cup of coffee. 13/3/2017 Investment Shock AbsorbersYou can drive a car with a broken suspension system, but it will be an extremely uncomfortable ride and the vehicle will be much harder to control, particularly in difficult conditions. Throw in the risk of a breakdown or running off the road altogether and there's a real chance you may not reach your destination at all.

WE TEND TO FAVOUR THE ALREADY FAMILIAR Everybody loves the comforts of home, but investors who become too anchored to familiar territory can end up with a very narrow view of the world. Home bias, the tendency of investors to allocate a disproportionate amount of their money to their domestic market, is a well–documented phenomenon.

Picture your first years in retirement. Things are going great. Days spent playing with the grandkids, sunny mornings on the golf course and leisurely walks on the beach - your very own version of nirvana! Before you completely relax into your golden years though, you should be aware of a potential financial pitfall that can be devastating just as retirement begins.

There are few keener advocates of index funds than the world’s most famous investor, Warren Buffett. Over many years, Buffett has consistently stated that indexing is the logical solution for the vast majority of investors. He did it again at the Berkshire Hathaway shareholders’ meeting a couple of weekends ago. |

RSS Feed

RSS Feed

7/8/2018