07 5440 5794

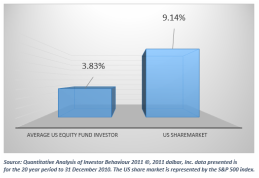

Do you want to know a secret? Building long-term wealth through investment doesn’t have to be complicated. And it doesn’t depend on making forecasts. The simple fact is that market returns are there for the taking, so long as you stay disciplined and build a diversified strategy around risks that carry a reliable reward. Like the weather, markets are unpredictable. But long-term investors don’t need a forecast to succeed. They just need patience and discipline to harvest returns that are there for the taking Working with the market So the good news is that as a long-term investor, you don’t need a crystal ball. And you don’t need to knock yourself out trying to beat the market. You just need to work with the market by capturing the compensated returns that are there for the taking. The facts are that beating the market consistently is extremely difficult. Markets are highly competitive – so much so that they do a very good job overall of absorbing new information quickly and adjusting prices accordingly. How? Last year, 60 million share trades happened on average every trading day. Many millions of opinions every day about the future prospects of individual companies are built into share prices as people buy and sell.  The mistakes we make The tragedy is that most investors don’t get the rewards available to them. This chart tells the story. It compares the returns delivered by the US share market over a 20-year period with the returns received by the average equity fund investor. You can see there was a lot of leakage along the way as the market produced better than twice what the average investor received. People don’t get the returns they are entitled to for a number of reasons: So, for example, if there are signs that an economic slowdown is ahead, investors as a whole might push share prices lower as they seek safer investments. This news is built in to share prices very quickly. So much so, that by the time we read about it in the newspaper, prices have already adjusted. In our electronic world, knowledge and information flows so quickly and freely that no-one consistently has a head start on anyone else. The traditional approach to share trading is to try to beat the market by taking advantage of pricing mistakes. But this is very much a hit and miss business as share prices reflect all known information. What do you know that millions of others do not?

Some of these mistakes are due to human nature. Some are due to the fact that much of the financial services industry makes its money by encouraging people to constantly reconsider their portfolios. And some are due to people being swayed by a short-term focused financial media. So what do you need to do to build long-term wealth? The key is to recognise the things you can’t control – the markets’ daily ups and downs and the daily noise from the media – and focus on the things you can:

These are all decisions you can make with the help of a financial advisor who puts your interests first. There is no single, perfect portfolio by the way. It will depend on your own lifetime goals and your appetite for risk. So the starting point should always be you and your own needs, not what someone is trying to sell you. If you work on the assumption that markets work, the job is much easier. That frees you up to build a diversified portfolio that suits your own risk appetite and goals. You seek to capture risks that generate an expected return and reduce the risks that do not. You pay heed to costs and taxes. And once you’re set, you stay disciplined. This article was prepared with the support of Dimensional Fund Managers – www.dimensional.com Disclaimer

This article and opinion is based on generally available information and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Jake

8/8/2015 11:09:54 am

Hi there Comments are closed.

|

RSS Feed

RSS Feed

7/8/2018