07 5440 5794

|

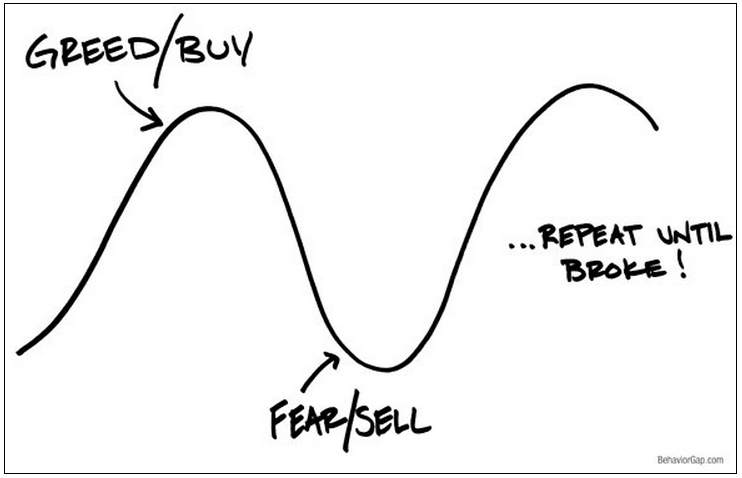

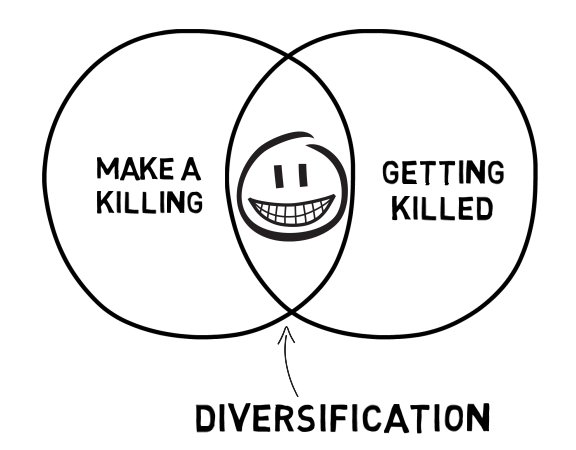

A great takeaway from one of my favourite money books, The Most Important Thing by Howard Marks is about understanding cycles. Here is how he explains it: “I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.” The problem is that each cycle is different. So it’s very difficult to convince yourself that; a) The good times will eventually end OR b) The bad times won’t last forever. What this means is that we tend to sell after prices go down and we buy after a run-up in price. My all-time favourite Behaviour Gap sketch by Carl Richards sums it up beautifully: Well, we are at one of those points again. The combination of a record number of retirees (needing investment income to live), record low interest rates and lots of money in cash has meant that property and shares were only ever going to go up for a while. Roger Montgomery is calling it, “The Boom We Had to Have”. Where this cycle may be a little different is that lower rates have encouraged traditionally risk-averse people into buying riskier investments. Their perception of risk has been ‘skewed’ by next to no returns from cash, too-cheap loans and booming share and property prices. With interest rates likely to be low for a while, the party could go on for some time. But when the music stops, and it will, do people really understand what they have? Do they follow the mistakes of history and allow fear to take over and sell low? Can they sell at all? Do they have time to recover? What impact does that have on future lifestyle? Of course, none of this can be predicted. The best choice for people really is to build a long-term and diversified approach. Understand risk. Believe it or not, find that point where you won’t make a killing, because you won’t get killed there either. If you seek advice about these issues, make sure it is the right type – no conflict, fee only and not distorted by ties with big institutions and product providers.

More on that here.

R

27/3/2015 03:49:39 am

great article mate. Love the pictorials too. Comments are closed.

|

RSS Feed

RSS Feed

10/7/2018