07 5440 5794

|

In a previous blog, I talked about 5 things that we can learn from happy retirees. One of these 5 was to honour something known as the ‘rich ratio’. I’ve had a couple of requests to dive a bit deeper with this so here goes:

29/6/2020 Busting Budgeting MythsUnfortunately, the word budget gets a bad rap.

Some people reckon it makes them look cheap and takes all the fun out of life. We reckon that could not be further from the truth! Here are some budget myths we wish would go away: Who does not want to be confident and relaxed about their financial future? To be that way, most of you recognise that you need to be in control, and on top of your money.

After all, the future is coming whether you plan for it or not. Will you have the retirement you want, or what happens to you by default? About the most effective thing you can do to get ahead is so basic, I am almost embarrassed to say it – spend less than you earn and do something sensible with the difference. The problem is, so few people do this successfully. Creating and sticking to a budget is not easy. 26/6/2018

War for your walletWe engage in battle every day. Sadly, many of us are losing the fight. It's the war between wants and needs.

You don't need a new car but you sure do want one. Those expensive shoes - you've just got to have them. That newest electronic gadget. You really don't need it, you just really want it. William Bernstein has several good reads, including the one I’ve just finished The Investor’s Manifesto, Preparing for Prosperity, Armageddon and Everything in Between. (yes, I was lured by the title)

For those that haven’t heard of William Bernstein, his status is legendary in financial circles. There’s a couple of things that I really like about him – 24/4/2018

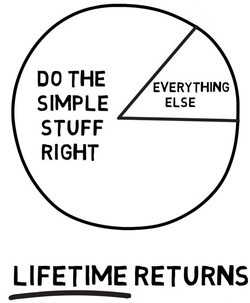

Simple ≠ Easy “It can’t be that simple, surely”, is something I hear a lot. People just assume that money management is complex. That’s no surprise really, as the traditional financial industry is built on the premise that complexity equals value or to be more pointed, the more complex the solution, the more someone should pay for it. The industry is very willing to sell you this crap. The media don’t help either as eye-grabbing content sells. 17/4/2018

The Espresso StrategyWhen you haven't got much capital of your own, the road to financial security can seem long and arduous. But the truth is that wealth building is actually pretty simple.

All it takes is time and the price of a cup of coffee. A third of marriages end in divorce*. Relationship breakdown is an emotionally difficult time, that can have a significant financial impact as well, This impact can continue well into later life. For example, households with men and women aged 55–64 years who haven't divorced earn around $10,000 a year more than those households headed by divorcees**of the same age.

27/3/2018

How much debt is enough?In the perfect world, we’d all be debt free.

For most of us though, we can’t get by without it. The question is, how much debt is enough? As they say, a little bit of something is alright, but too much is another story. 13/3/2018

The Cost Of UrgencyHumans are hardwired to want things -- now. It’s called instant gratification, and it’s a powerful force. In most psychological models, humans are believed to act upon the “pleasure principle.” The pleasure principle is basically the driving force that compels human beings to gratify their needs, wants, and urges.

|

RSS Feed

RSS Feed

21/10/2020

6 Comments