07 5440 5794

|

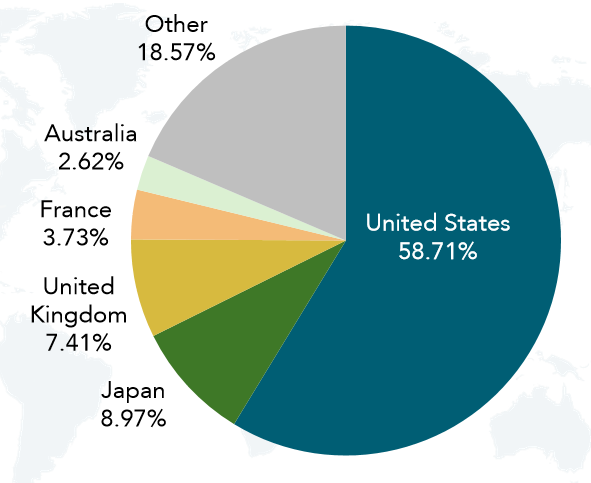

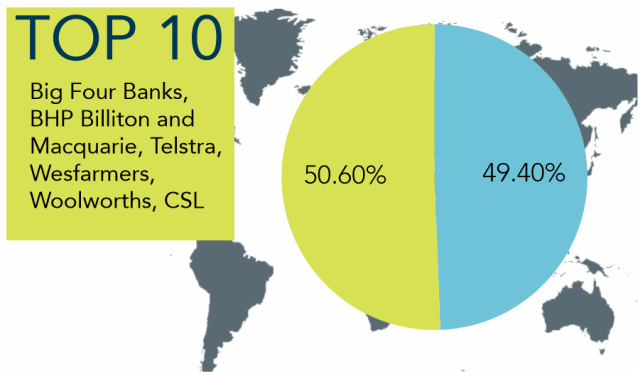

WE TEND TO FAVOUR THE ALREADY FAMILIAR Everybody loves the comforts of home, but investors who become too anchored to familiar territory can end up with a very narrow view of the world. Home bias, the tendency of investors to allocate a disproportionate amount of their money to their domestic market, is a well–documented phenomenon. Of course, there can be rational reasons for sticking close to home. In Australia, there is the advantage of dividend imputation and franking credits. There is the familiarity of the local market and its companies. We might shop there or use their services. And home bias also can be justified by an investor's particular goals or risk appetite. There is no one right answer here. But a large home bias also can have unexpected and potentially dangerous consequences. Those consequences relate to the risk of having a very concentrated exposure to individual countries, companies and industries. In Australia, for instance, the typical home bias is one where the investor allocates 80 per cent of her equity portfolio to the local market. This is despite the fact that Australia represents a little over 3 per cent of global market capitalisation. Given an Australian investor typically also sources most, if not all, of their income from Australia and holds most, if not all, of their other assets here, this home bias in equity investment represents a very big bet on one country. WORLD MARKET SNAPSHOT Source - Bloomberg Now think about company risk. Only four of the top 100 companies in the world by market capitalisation are Australian – Commonwealth Bank of Australia (#58), Westpac (#72), ANZ Bank (#84) and National Australia Bank (#88). Australia does not have one company in the top 50. A portfolio with a 80 per cent home bias to Australia will underweight such names as Apple, Microsoft, General Electric, IBM and Exxon Mobil. In fact, a single company – Commonwealth Bank – would make up nearly 8 per cent of the portfolio. That's a big bet. Put another way, just 10 shares make up half the Australian market, as represented by the S&P/ASX 300 index. They are the major banks, diversified miner BHP Billiton as well as Telstra, Wesfarmers, Woolworths and CSL. That is a very concentrated bet. AUSTRALIAN MARKET SNAPSHOT Source - Bloomberg The other risk is sector concentration. In a world market portfolio, the materials sector (which covers the miners) represents less than 10 per cent of the total. In Australia, that proportion increases to more than double that. In a world market portfolio, financials (a sector which covers the banks) represents just over 20 per cent of the total. In Australia, that proportion increases to 30 per cent. In other words, more than half the Australian market is made up of just two sectors – miners and banks. Again, it may well be a matter of taste or preference for an individual investor to have a home bias. Franking credits are often cited for investing mainly in Australia. But this can come at the cost of company and sector–specific risk. Local banks, for instance, are particularly sensitive to the vagaries of the Australian housing market. For most of the past decade, that has been a positive influence. But with credit growth slowing and housing affordability stretched, markets are pricing the risk that these beneficial forces will go into reverse. Are you comfortable with that? The good news is that there are ways of dealing with these risks without compromising a desired home bias. These include tilting away from the big miners and banks to smaller companies within the Australian portfolio. It should be noted that this swaps one kind of risk – concentration risk – with another kind of risk – small company risk. But it does allow for a more diversified allocation and decreases the dependency of the portfolio on a handful of mega cap stocks. Aside from the arguments against excessive home bias, there are also positive arguments for more global diversification. It creates a portfolio that spreads its risk to more economies, a greater number and a wider range of companies and a wider spread of sectors. Information technology, for instance, is not well represented in Australia. There will be times when Australia outpaces global markets, as we saw last decade. But there will also be times when Australia lags, as we have seen more recently. A globally diversified portfolio reduces the risks associated with a single economy or market. WORLD SHAREMARKET PERFORMANCE (Click image to see a bigger version) Source - MSCI Again, there is no single right answer in terms of asset allocation. It will depend on the individual investor. But it is worth reflecting on the fact that an investor whose allocation is made up 80 per cent of Australian equities is overweighting Australia relative to the global market by a factor of 20. Sometimes, it may be worth loosening the apron strings, at least a little. This article was prepared with the assistance of Dimensional Fund Advisers IMPORTANT - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. Before acting on this information, you should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Bert

27/10/2016 12:58:42 pm

I noticed that my super has got about 50% of the shares exposure to overseas companies. If you reckon the Australian economy is only 3% why do they still have that much in Australian shares?

Reply

Tony

7/11/2016 04:22:27 pm

Bert, that would be a good question for your super fund, however there has been a trend toward more international exposure. For example, the country's biggest fund is AustralianSuper and its total international exposure is nudging up toward 50%. 4 years ago that was 31% according to its annual report.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

19/10/2016

2 Comments