07 5440 5794

|

So you've got a little spare cash. Not sure whether you should repay your mortgage sooner and pay extra in to super?

A lot of people wait until their home loan is paid off before investing more in super. Is that the right strategy in the current market? Could you be better off when your retire if you make additional super contributions instead? It's one of the most common questions we get. Here are some rules of thumb you can follow to work out what's right for you. 19/11/2022

Don't worry, the market will tank againHello volatility, welcome back. It’s been a while.

As share market investors, we should appreciate that we’ve had it pretty good for well over a decade. It’s hard to understate how smoothly world equity markets have climbed since things settled down after the 2007-09 Global Financial Crisis. 18/11/2022 A man, his dog and the sharemarketI took our dog for a walk down to the beach last night. It’s one of those white, fluffy things – it has way too much energy and I need a very long lead. I was walking from home, through the dunes, to the beach. I’m going at a slow and steady pace, heading pretty much in a straight line, with only the occasional detour to walk around a fallen log.

17/11/2022 Are You Retirement Ready? Find Out.It can be hard to know if you’re doing well with your money or not, so we’ve taken the guesswork out of it for you.

Follow the link below to take our quick quiz and work out if you’re doing all the right things with your money or need to pull your socks up, as well get some ideas about what you should be doing next. You can access our quiz below Investment markets have been as volatile as I can remember in a long time.

This is all part and parcel of the share market investment experience. If you open the door for better returns, expect some shenanigans along the way. Markets will recover. As long as you have time on your side, there’ll be no real damage done. But what if you are retired. Volatility is back. While I’m not one to make short term predications, I expect this will continue for a while.

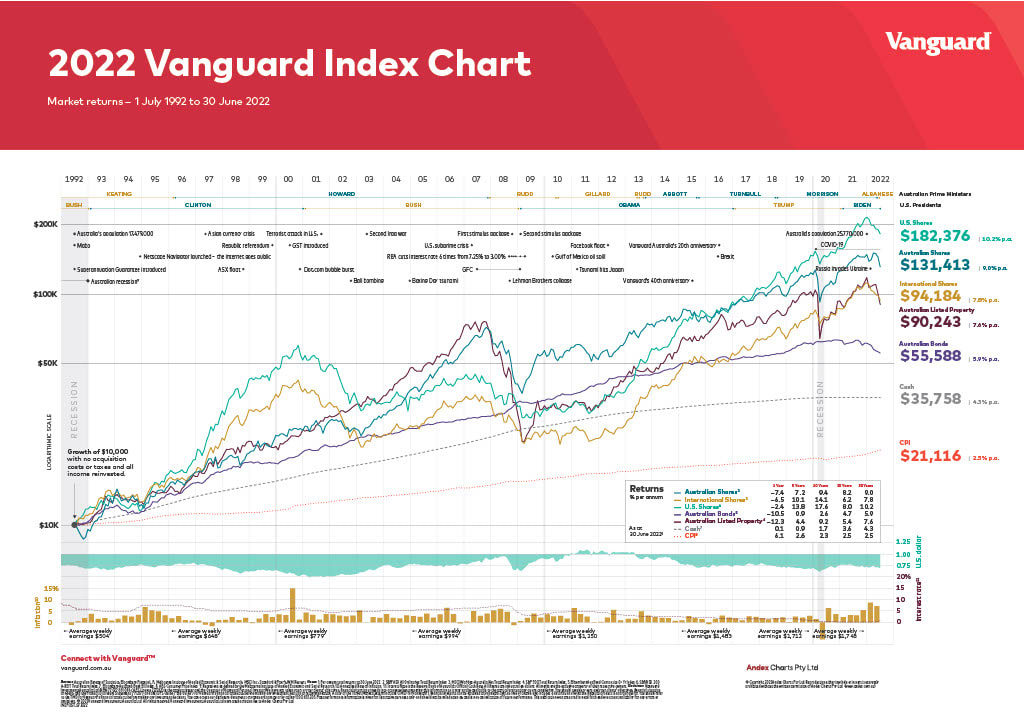

If history is anything to go by though, eventually we’ll look back at this period as just another speed hump on the long-term share market graph. Check out this chart provided by Vanguard. To retire isn’t a simple case of working one day and not working the next. Retirement significantly impacts every aspect of your life, especially how it affects your standard of living.

Ultimately, it’s our own responsibility to get organised, but too many workers are disengaged from retirement planning, especially during the early parts of their work life. They know they should be saving for retirement, but they don’t really understand what a comfortable retirement might look like. Often, they don’t know how to set a realistic goal or how to get there. So, what represents a good retirement income? Around this time each year, you are probably putting in place plans for the financial year ahead.

Maybe you even achieve some of those goals. But you could never have planned for some of the unexpected events, opportunities, twists and turns of recent times. Take me for example. Every great accomplishment had a sound strategy behind it. Winging it might spice up your life, but having no plan is a recipe for disappointment. Great feats are achieved as a result of people knowing what they want and why!

Think about your favourite professional sports person or business super achiever. Do you think it’s possible that he or she became successful without first setting up a target and then taking aim? Not likely. One rainy afternoon in 1940, an inspired 15-year old boy named John Goddard sat down at his kitchen table in Los Angeles and wrote three words at the top of a yellow pad, "My Life List." Under that heading he made a list of everything he wanted to achieve.

|

RSS Feed

RSS Feed

13/4/2023

4 Comments