07 5440 5794

|

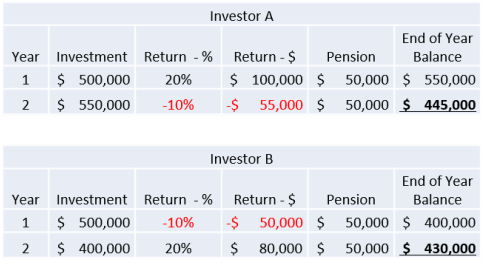

Investment markets have been as volatile as I can remember in a long time. This is all part and parcel of the share market investment experience. If you open the door for better returns, expect some shenanigans along the way. Markets will recover. As long as you have time on your side, there’ll be no real damage done. But what if you are retired.  Photo by Jason Briscoe on Unsplash You still have to eat. You still have to draw pension payments. You might even have to sell investments to fund those pension payments. And selling when markets are depressed can really play havoc with how long your funds will last in retirement. You might not think it makes much difference if markets recover in the end. You’d be wrong. Here is a very simple example to explain why. Retiree A and Retiree B are identical in that they have the same investment dollars, they draw the same income and their investment earnings are the same - positive 20% one year and minus 10% in the other year. The only difference is that the order of those returns is reversed. Check out the difference in balances at the end of two years. While the average return is the same, the results are quite different. It was this timing of returns that proved so devastating to many new retirees during the GFC. Take this longer example. Two investors make superannuation contributions of $10,000 per annum over a 20 year period. Let’s also assume that their average return was also identical, at 7%. And finally let’s assume that the returns of each investor were identical in years 2 through 19. The only difference was that investor 1 had a -10% return in year 1 and a +10% return in year 20 and Investor 2 had the opposite - +10% in year 1 and -10% in year 20. What difference would it make. Heaps!! As investor 2 experienced a significant negative return in the final year, the time at which the balance was the largest (and closest to retirement), his account balance at the end was $402,634,$81,000 lower than the $483,636 balance of Investor 1. There are several simple strategies that retirees can implement to reduce this imapct.

While these tips are meant to point you in the right direction, there’s no substitute for good financial advice financial advice. This is too important not to get right. Get practical advice and act now. Your financial future may depend on it. Want to know more. Read 8 Investment Risks Retirees Can Not Ignore. Subscribe to regular updates sharing our best ideas on wealth management and personal development. Just enter your email for tips and resources to get your financial house in order and positively impacting your life today. IMPORTANT This information is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each individual and investor are different and you should not act on this information without speaking to a financial, tax or legal adviser, who can consider if the financial product and strategies are appropriate for you. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Peter Flavell

23/2/2016 07:29:47 am

This is useful, thanks. I'm implementing the liquidity suggestion and feel better about things already.

Reply

Tony

2/3/2016 06:32:14 pm

Great to know Peter you are getting some value.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

16/11/2022

2 Comments