07 5440 5794

|

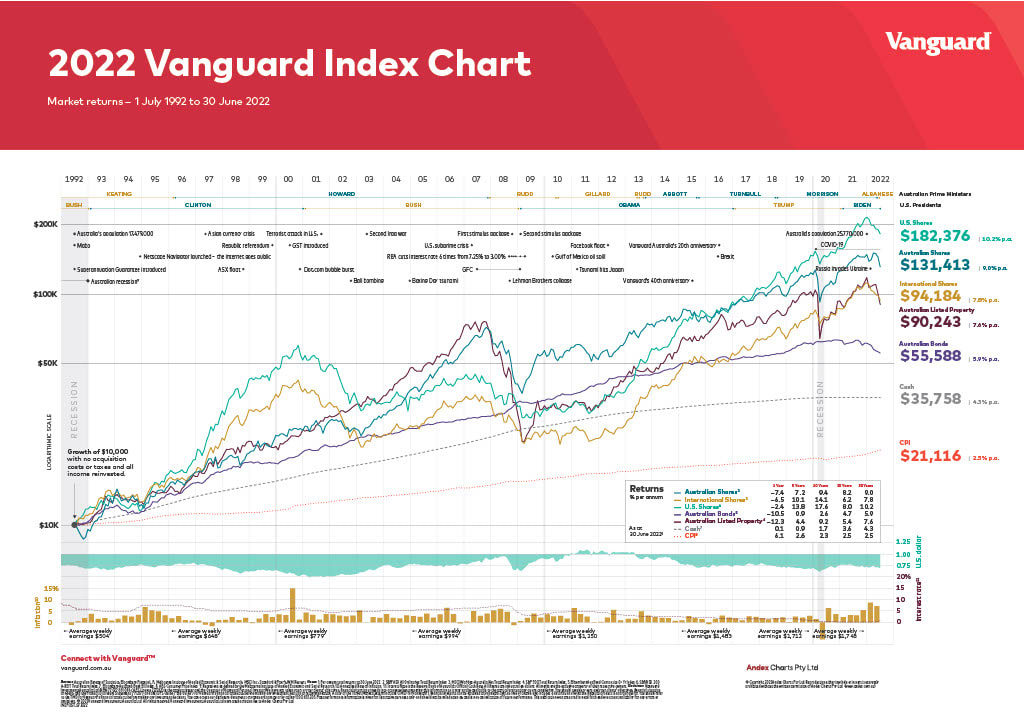

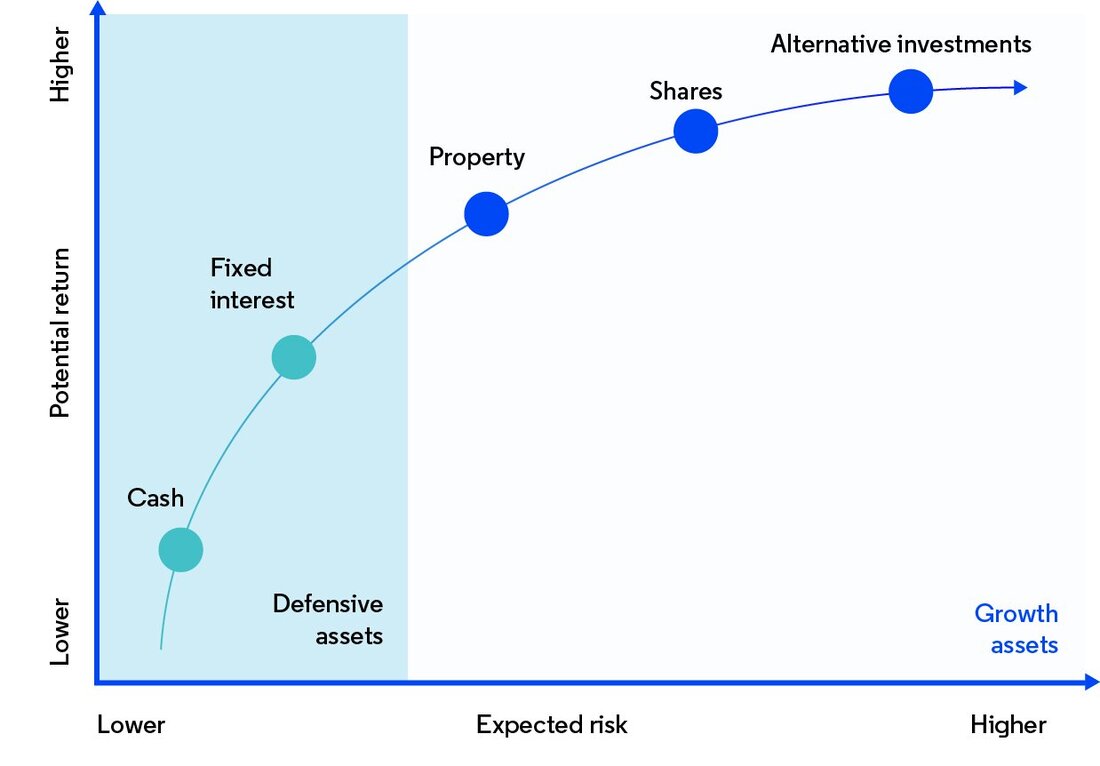

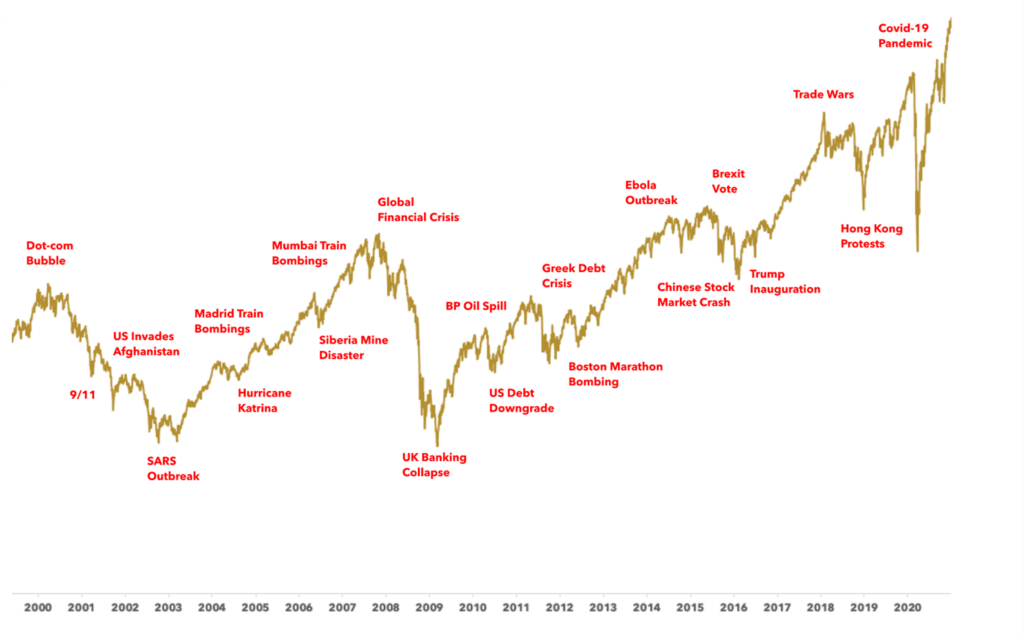

Volatility is back. While I’m not one to make short term predications, I expect this will continue for a while. If history is anything to go by though, eventually we’ll look back at this period as just another speed hump on the long-term share market graph. Check out this chart provided by Vanguard. One thing I know for sure is that impulse is your enemy. While volatility is a source of discomfort for all of us, it tempts us to make near-term decisions that just aren't good for us. Sometimes, it’s hard to resist counterpunching. But you need to focus on factors that you actually have some control over. You can’t control interest rates, economic variables, volatility in shares and bonds, and the ever-changing news cycle. But you can control how you react to those things. And there are other levers you can pull, whether you are still working or whether you are approaching or already in retirement. Having witnessed numerous economic cycles and market ups and downs in more than 30 years as a financial adviser, here's Nine Tips for investing in turbulent times that will hold you in good stead. 1. CompoundingCompound interest is magical! The value of $1 invested in 1900, allowing for the reinvestment of dividends and interest along the way, would now be worth $243 if invested in cash, $901 if invested in bonds and $757,136 if invested in shares. If you want to grow your wealth, you should have exposure to growth assets like shares and property. 2. DiversifyThe best performing asset class each year can vary dramatically – last year’s top performer is no guide to the year ahead. Have a combination of asset classes in your portfolio. This particularly applies to assets that have low correlation, i.e., that don't just move in lock step with each other. A well-diversified portfolio is less volatile. 3. Understand Risk and ReturnPut simply: the higher the risk of an asset, the higher the return you should expect to achieve over the long-term, and vice versa. There is no free lunch, and you should always allow for the risk and return characteristics of each asset in which you invest. If you don’t mind short-term risk, you can take advantage of the higher-returns growth assets offer over long periods. 4. Time In, Not TimingIn times of uncertainty its temping to try to time the market. But without a proven asset allocation or stock picking process, it’s next to impossible. Market timing is great if you can get it right, but without a process, the risk of getting it wrong is very high and can destroy your longer-term returns. Selling after big share market falls can feel comfortable given all the noise is negative but it locks in a loss and makes it much harder to recover from. 5. Time is on Your SideSince 1900 there are no negative returns over rolling 20-year periods for Australian shares. Short-term share returns can sometimes see violent swings, but the longer the time horizon the greater the chance your investments will meet their goals. In investing, time is on your side, so invest for the long-term. 6. Remove the EmotionEmotion plays a huge roll in amplifying the investment cycle, both up and down. Avoid assets where the crowd is euphoric and convinced it’s a sure thing. Favour assets where the crowd is depressed, and the asset is under-loved. Don’t get sucked into the emotional roller coaster. 7. The Wall of WorryIt seems there’s plenty for investors to worry about at the moment. While this is real and creates uncertainty, in a long-term context its mostly noise. The global and Australian economies have had plenty of worries over the past century, but they got over them. Australian shares have returned 11.8 per cent per annum since 1900. Turn down the noise around the short-term movements in investment markets. 8. Look LessDay by day it’s pretty much 50/50 if share markets end up or down. On a monthly basis, they finish up two thirds of the time. On a calendar year basis, using data back to 1900, this increases to 80 per cent. The less you look at your investments, the less you will be disappointed, and the less likely you’ll sell at the wrong time. 9. It's CyclicalThe higher returns shares generate over time relative to cash and bonds is compensation for periodic short-term setbacks. Recognise that these setbacks are part of the cycle. Don’t get thrown off the higher returns that shares and other growth assets provide over the longer-term. Cycles are a fact of life and, while they don't repeat precisely, they rhyme. Important - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

21/7/2022

0 Comments