|

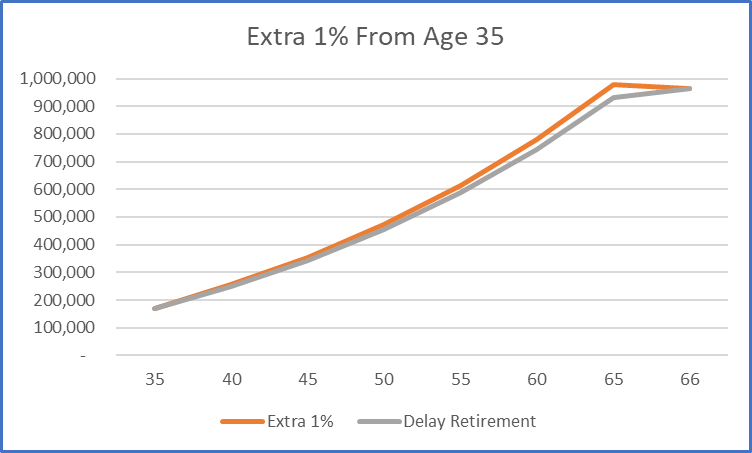

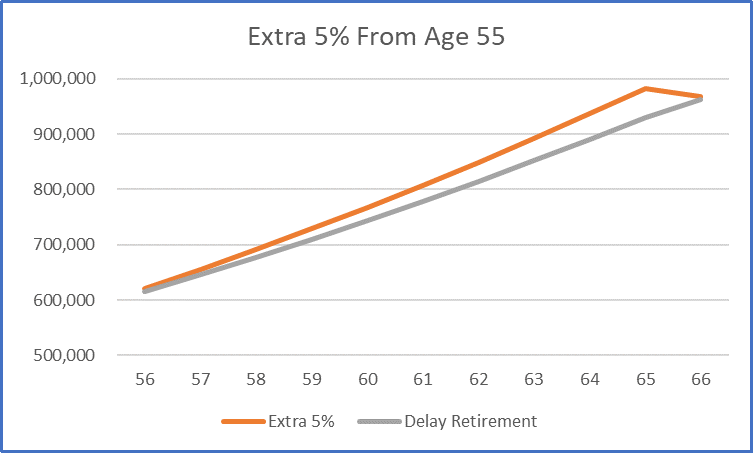

Saving and investing for retirement are important. But for most people, another strategy is far more powerful - working a bit longer. Keep reading. There are some provocative nuggets here. Say you are 35 and plan on retiring in 30 years. You are already saving but realise that you will need more money. You can increase your savings by 1 percent every year until you are 65 or extend your working life by about 12 months. Those few extra months on the job are likely to raise your retirement nest egg by the same amount as those 30 years of extra savings. If you are older, the numbers are just as startling. Say you are 55 and realise that you need more retirement income when you stop working in 10 years. You can save 5 percent more for the next 10 years until you are 65 — or work for just 12 extra months for the same result. Scratching your head and want to see how I've come to those numbers? Download the calculations here. Many of you will find this eye-opening. However, this should not down play the importance of saving as much as you can for as long as you can or keeping a lid on fees and taxes. These are all time-tested approaches. But it suggests that retirement planning may not be focusing sufficiently on a basic truth: many people simply can’t afford the life after full time work they want and have no choice but to keep working in some capacity, and that delaying retirement could have more impact on their bottom line than virtually any other strategy (learn more about the 3 types of retirement here). And if the thought of working a bit longer is enough to make you depressed, remember, work is a lot more than just money. Work provides purpose. You get to accomplish something every day. There are problems to be solved and new things to learn constantly. It provides important social interaction. This all leads to good physical and emotional health and cognitive function. The trick is to find something you enjoy doing, and get paid for it. Now that's a goal worth aiming for!! See more about what makes for a successful retirement here. If you'd like to see how retirement ready you are, you can schedule a free 20 minute call here. This is a model, not a prediction -The results from this simulation are based on limited information and assumptions made about the future. The amounts projected are estimates only and are not guaranteed. This calculator cannot predict a final retirement benefit with certainty because this will depend on personal circumstances including unexpected events in life and external factors such as investment returns, the order of those returns, tax, inflation, how much income you earn and how much you contribute to retirement plans. This simulation assumes that steady, predictable contributions are made and that all assumptions including these external factors will operate at set, steady rates for the length of the investment, even if events turn out differently from what's assumed. These assumptions are essential so the simulator can show the effect of things that can be controlled, such as increasing a level of contribution or delaying retirement.

Other important information - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Richard

27/2/2019 07:19:48 am

Hey Tony, good explanation. For those people who don’t quite have enough money to retire, retiring later seems the least palatable option, but also the most effective.

Reply

Tony (Author)

28/2/2019 04:09:52 pm

Richard, there are always plenty of options to improve a situation. None of them are particularly palatable. One is to do nothing, spend beyond your means and risk outliving your capital. Another is to accept you won't have a big enough nest egg and try to get by on less income. This blog looks at tightening the belt now and save that money for spending down the track. The other one we explored in this blog is to keep working a little longer, and as this case study shows, it’s a very effective strategy. Others try to earn more on their money. Understand though that risk and return are intimately linked, and those close to retirement need to be particularly careful. Poor returns around your retirement date can be devastating. Read more on that here.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

11/2/2019

2 Comments