07 5440 5794

|

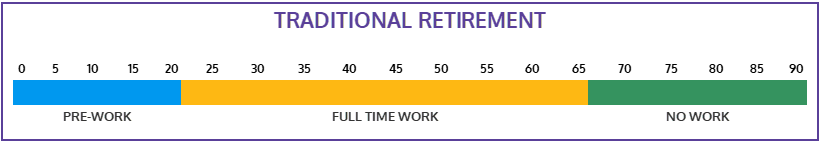

There used to be a ‘traditional’ approach to retirement. It went like this.

Save as much as you can for as long as you can so that one day you’d have enough to stop work completely and start living a life of leisure. For those that couldn’t save enough, there was always the age pension to fall back on, and for the others, the more and faster you could save, the sooner you could stop work and the more leisure time there would be.

Well, that approach is changing.

Not only is there a growing base of academic research showing that fewer people want a retirement of no work and all play, I speak with people every day who are telling me the same thing.

Some of the research is saying that to many, with the prospect of such a long time in retirement, things could get boring!! Other research shows that many people simply can’t afford the life after full time work they want and have no choice but to keep working in some capacity. Either way, only about half of today’s retirees say they never intend to work again.

Whether it be scaling back to just a few days a week, getting some casual or seasonal work, starting your own business or pursuing the career you've always dreamed of, more and more people are choosing a different path to the traditional approach to retirement.

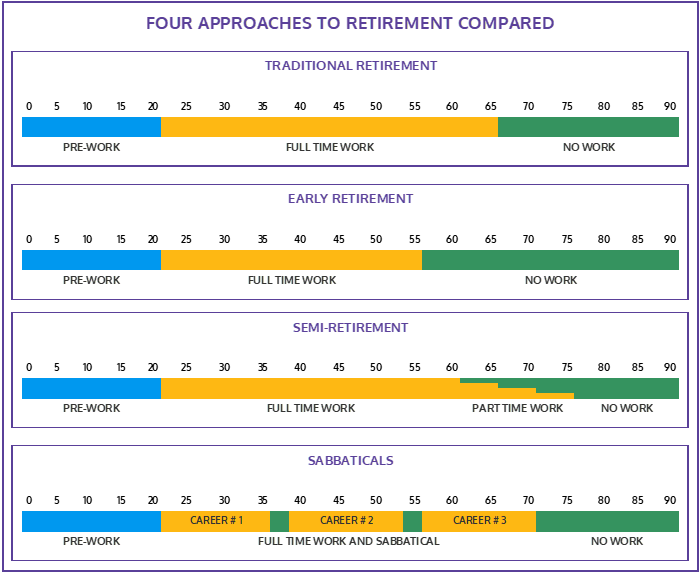

So, if an intense period of work followed immediately by an intense period of leisure is not the ideal approach for many of us, what are the alternatives? Well, there are several different approaches to retirement that can offer a completely different balance between work and leisure. We are going to focus on two of these strategies, which are the ones that are most discussed with me by clients.

The significance of these changes is that the traditional approach to saving and investing for retirement may not work for either. What is interesting is the maths.

And your retirement investment portfolio may look very different as well. That would be expected if your nest egg is more like a buffer for a transition to retirement, rather than having to replace an income completely.

Let’s look at each of these options in a little more detail. Traditional Retirement – From All Work To All Play

For most of human history, people ‘worked’ to survive. The notion of retirement is in fact a relatively new concept. In 1881, Otto von Bismark, the conservative prime minister of Prussia, presented a radical idea to the Reichstag – government run financial support for older members of society.

In other words, retirement. A truly progressive idea for the time, until then people simply did not retire. If you were alive, you worked. As health and life expectancy improved, von Bismarck argued that “those who were disabled by age have a well-founded claim for care from the State” Note the distinction. The original scheme was designed to assist those that couldn’t work, not those that reached a certain age and just decided they didn’t want to. A national Social Security system started in Australia in 1909. Up until then, you either kept working or relied on charity. As we have continued to live longer over the past century, the nature of retirement has fundamentally changed. It’s no longer a last resort if you can’t physically or mentally keep working, but a period that is a now seen as a “phase of life” – a time after work of planned leisure, the culmination of a lifetime of working and saving. This “traditional” type of retirement is the one that we’re all most familiar with – save early and often, invest for growth, and retire as soon as you’re financially able. If you can grow your retirement portfolio fast enough, you can retire early. If not, you’ll at least be able to retire in your 60's when Social Security becomes available. The time in retirement is filled with leisure, or perhaps engagement through volunteer “work” (but without getting paid).

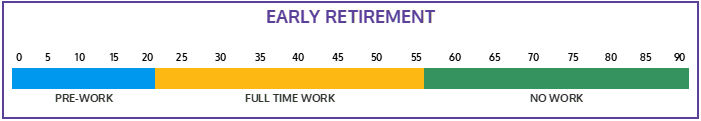

It is no surprise then that people want to maximise their leisure time. This has driven a focus on retiring “early”. That means it’s necessary to save more as you need to support yourself longer, which of course means trade-offs of spending less today.

Two Alternative Types Of Retirement

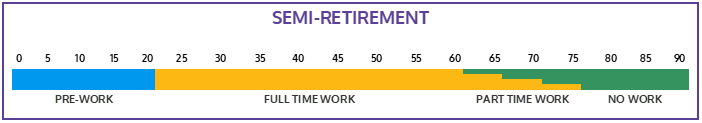

The first alternative to the “traditional” or “early retirement” model, is a form of “semi-retirement”, where work is scaled back, but not eliminated. This is a time of some work and some leisure, working just a few days per week. This might mean starting a business, pursuing a new career or engaging in consulting or part-time work in a prior career.

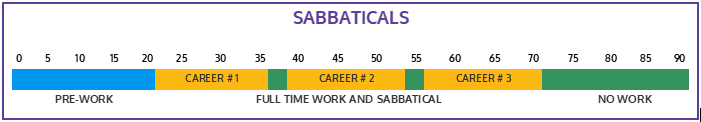

Alternative two is engaging in a series of “temporary retirements” – planned sabbatical breaks, after which there’s a return to work, potentially in new job or career path. In this approach to “retirement”, the act of retiring – withdrawing from the working world – is not something that comes at the end, but instead is dispersed throughout the working life, perhaps as transitions between extended careers.

The pace of sabbaticals could be less frequent but for longer periods of time, or for shorter periods that occur more often, depending on the type of work or profession you have chosen.

In both these options, the phase of retirement at the end would be shortened, as that leisure time is redistributed into earlier phases of life. Saving For Different Types Of Retirement

The reason why this discussion around the different types of retirement is so important is that the “standard” saving for retirement approach really only works for the traditional or early retirement model.

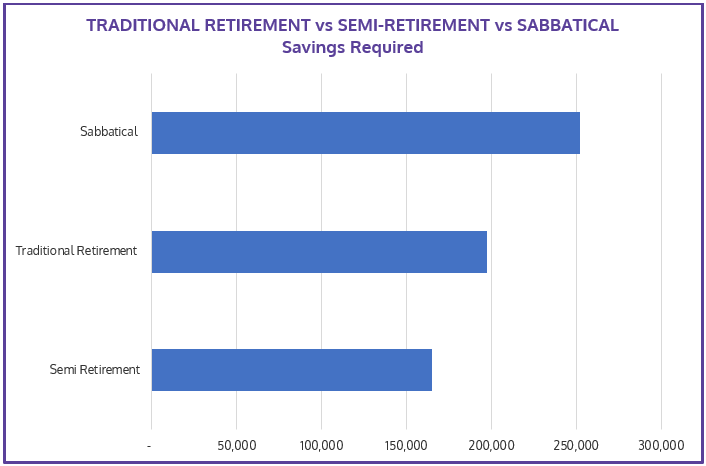

In the alternatives, as there is not such a long period of “no work” (and no income), you may not need as many retirement dollars in the first place!

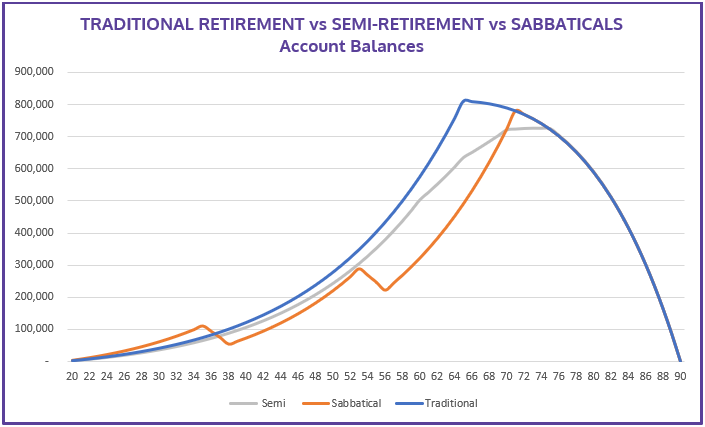

As shown above, with a couple of sabbaticals, the retirement savings account never quite accumulates as high. And it doesn’t need to because the “no work” phases are not as long.

But there’s a catch!! Because of the drawdowns on savings during the sabbatical periods, retirement savings never quite get the full benefit of compounding. This means spending less and saving more to make the “life balance” work. A lot more will need to be saved to maintain the same standard of living (see table below).

That is a trade-off decision you’ll need to make when choosing the ideal type of retirement for you.

Similarly, if you choose to engage in semi-retirement, you won’t need anywhere near the capital required to retire completely from the workforce, nor will you have to save as much to get there. There’s a couple of reasons for this: One, because human capital – the value of earnings from continued work – is actually worth a lot as a retirement asset! And secondly, the retirement savings have longer to grow and more time for the magic of compounding to work. So what’s The Optimal Lifestyle for you? Let’s summarise the pros and cons. Traditional Retirement – Escaping the grind at age 65+ Advantages:

Early Retirement – Escaping the grind early Advantages:

Sabbaticals or temporary retirements - take a break when you need it Advantages:

Semi-Retirement –Like strolling a marathon … with breaks to take in the view. Advantage:

So what do you think? Will you find traditional retirement fulfilling? Will you keep working in some way? Take our survey and let us know what you think. Important - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here. Comments are closed.

|

RSS Feed

RSS Feed

15/10/2018