07 5440 5794

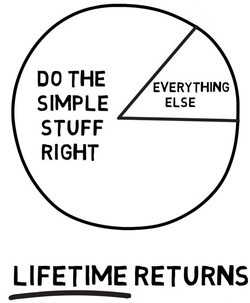

“It can’t be that simple, surely”, is something I hear a lot. People just assume that money management is complex. That’s no surprise really, as the traditional financial industry is built on the premise that complexity equals value or to be more pointed, the more complex the solution, the more someone should pay for it. The industry is very willing to sell you this crap. The media don’t help either as eye-grabbing content sells. But it is just not true. Most financial concepts are remarkably simple. But they are not always easy to do. Take your cash flow as an example. About the most effective thing we can do to get ahead is so basic, I’m almost embarrassed to say it – spend less than you earn and do something sensible with the difference. Yet so few people do this successfully. Creating and sticking to a budget is not easy. People often overlook the simple because they consider it too simple – “That couldn’t possibly work”. They seek the complex, seduced by “hot tips” and quick returns (that sounds a lot sexier as well!) But there’s actually another, bigger problem. Some people just don’t want a simple solution. How could that be? Because the simplest of things often mean the hardest of trade-offs. For example, when you hear, “Spend less, save more,” you might think:

Simple does not mean easy. Are these just trade-offs?

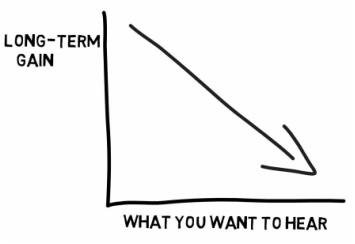

So to avoid the tough choices, many of us pretend that simple won’t get the job done and go looking for complexity, too often in our investments.  Whatever the reasons, simple solutions bring us face to face with some painful truths about what we do or don’t do. I’ve found that a lot of people just aren’t comfortable with this process. Some will avoid it completely. Others find it easier to spend time and money on complicated solutions that don’t require much, if any, self-reflection. So what to do about it. How do you push yourself to do something that you don’t want to do? What skill is required? Well, there isn’t a skill — it’s just forcing yourself to do something you don’t want to do. And that requires some kind of motivation. Without motivation, you won’t be able to force yourself to do anything. So motivation is the key concept — and this is something that’s real, that you can actually master. For mine, goal setting is the key to motivation – it really is your internal success mechanism. To find out how to fire yours up, read this.

michelle

8/8/2015 11:01:01 am

im in the fitness industry and can relate to this. simple things are often hard to do

Michelle

9/8/2015 01:59:29 am

Thanks Michelle for your comment. I'm watching a show right not that's saying most of those that diet end up worse off. The focus should be to do the simple things right eg take in less calories than you burn etc. if it were only that easy. So it is with money, we overlook the simple solutions that provide the proven and long term gain we all want. Comments are closed.

|

RSS Feed

RSS Feed

24/4/2018