|

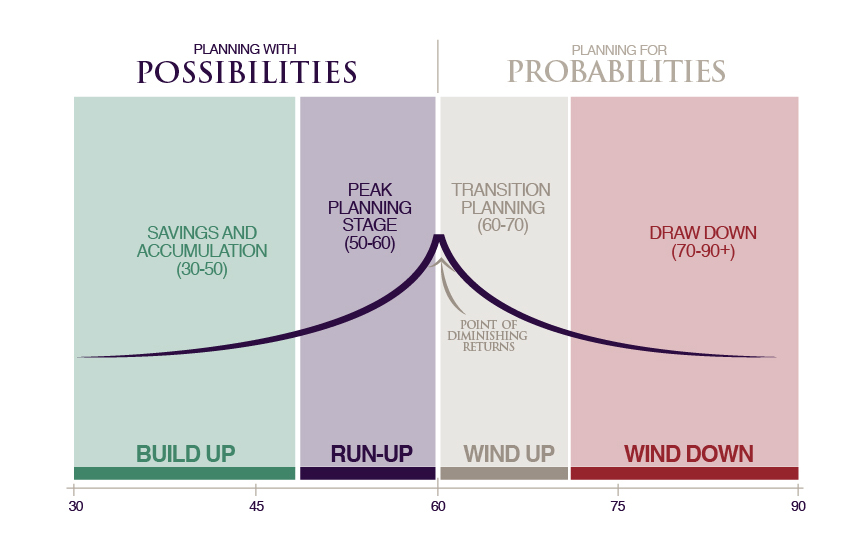

Many people avoid going to the dentist, because they expect it to be painful. You might know what I mean. That cracked filling - we never get around to doing anything about it until the darn thing falls out. Or even when faced with the choice of enduring a ‘sometimes’ sore tooth for several months versus going to the dentist, we generally try to ride out the bad tooth in the hope it will get better! And how does that work out for you? An ounce of prevention is worth a pound of cure. Sometimes I feel like a dentist. Far too often I meet people who are looking for their first piece of financial planning advice in their 60’s (or even later). Many of these people know, at least on some level, that they are woefully unprepared for their financial futures. And just when I think I’ve seen everything, another person arrives with a new level of “financial unpreparedness”. Everything from people with too much debt, those who haven’t been contributing anything to their retirement plans and those with poorly positioned assets. Many of these “wealth” injuries are very much like the “health” injuries. They originate because of neglect. And like the tooth, time is everything when it comes to your money. If we have time to create strategies, save and invest, financial goals can be accomplished. Without time, we are stuck with a much less appetising menu of options. This is no different to so many things in our modern lives, which have a date stamp. When we go to the supermarket to buy milk or a packet of biscuits, they’ll have a “best before" date. Now that doesn’t mean that you can’t consume them after that date, it’s just that they may not be as appetising. Although it may not be as easily visible as off milk or stale biscuits, planning for our financial lives has a "best before" date too. It doesn’t mean that you won’t get results if you plan after that date, it’s just that you’ll get much better results if you do something beforehand. Hey, don’t get me wrong. There are always things that can be done to improve a situation. My point is that there comes a point in time where the conversation changes from planning for all sorts of exciting possibilities, to managing much less appetising probabilities. Check out the graphic below to see what I mean. Where are you on the timeline? It's easy to understand why retirement doesn't loom large on the horizon for 20-somethings. Young workers are more concerned with kick-starting careers, not ending them in the long-distant future. And in your 30’s and 40’s, there’s probably extra mouths to feed and debt to reduce. But what about your 50’s? You are probably at the height of your career and there will never be a better time. The thing I know for sure is that the sooner you get started, the more likely it is you can plan for exciting possibilities, rather than just deal with the best way to manage the probabilities. Whenever you're ready....here are a few ways I can help you get on track to a stress-free retirement. 1. Follow us on Facebook and Twitter and sign up to our regular emails updates. They are great places for great ideas. 2. Grab a copy of our free Ebook. It's called “5 Money Must Do’s For The Over 50’s” and are the lessons learned from helping 1000’s of people find financial peace of mind over the last 30 years. 3. Work directly with me. If you’d like to work with me and my team to move from stressed and frustrated to relaxed and on track, you can schedule a phone call here. You’ll find out how we can help and if we are the right fit for you. 20 minutes, no obligation. IMPORTANT This information is of a general nature only and may not be relevant to your particular circumstances. It does not take your specific needs or circumstances into consideration, so you should look at your own financial position, objectives and requirements and seek financial advice before making any financial decisions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Mike

27/10/2016 01:15:53 pm

When's the best time Tony to get serious, and actually pay for some proper advice. My husband and I are about 15 years from retirement, I will always labelled financial planners as salespeople and thought I could do better on my own, and so far I think we've done pretty well. Although I'm never really certain we are doing the best thing, maybe there are better things we could be doing. Confusing!

Mike, the moment there is complexity you can't resolve yourself. I urge you to seek "genuinely" independent adviser, free of conflicts of interest. Most "indie's" will provide an initial meeting at no cost. Its an opportunity for you to establish is there is value in their process, and an opportunity for them to determine how (or if) they can help. Here are a couple of resources from which you can source "genuine" independent advisers. Have a read of their content too, there will be some other great tips on finding an adviser. Comments are closed.

|

RSS Feed

RSS Feed

13/4/2021