07 5440 5794

|

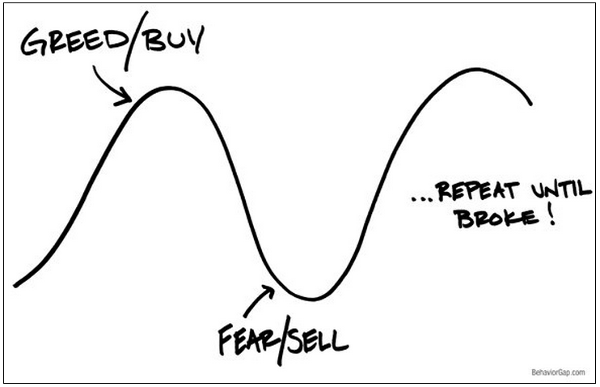

Investment mistakes cost you money – that’s why they must be avoided. What I’ve discovered over the years is there are only two ways to gaining the experience necessary to know how to avoid investment mistakes.

Frankly, I'm no glutton for punishment. The easy way makes sense to me. Avoid these mistakes, do better with your money and accelerate your journey to retirement happiness.

|

RSS Feed

RSS Feed

30/6/2020

2 Comments