07 5440 5794

|

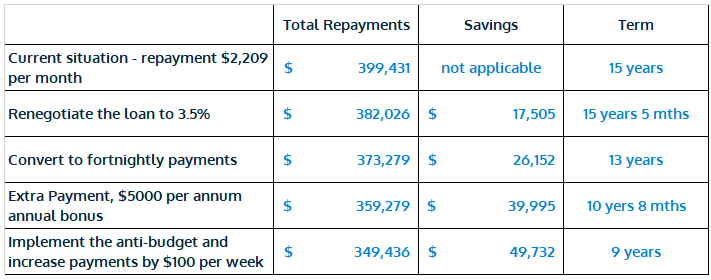

Retirement should be about freedom. But too many Australians are retiring without freeing themselves from the biggest master of all – debt and the Banks they owe money to. Actually, debt need not be too painful. What you need to do is to make sure you don't have too much to start with, having the right loan and then paying it off as quickly as possible. Let’s go through those in a bit more detail.

|

RSS Feed

RSS Feed

29/6/2020

2 Comments