|

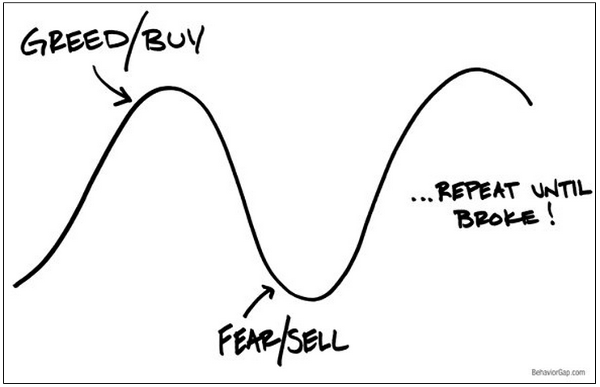

This month marks my 30th year as a Financial Adviser. Watching people grow and achieve, and knowing you might have had a little bit to do with that, has been incredibly rewarding. In those 30 years, I have immersed myself in the world of wealth management, coaching and mentoring. In fact, I’ve turned in to a bit of a hoarder, taking large amounts of notes and putting together a huge library of books and manuals. I’ve been fortunate too, to have mixed with and learnt from some of the world’s best practitioners. There’s hundreds of hours of recordings from these, and other people. Founder of Linkfluencer and entrepreneur, Alex Piroux, recently challenged me to narrow down those 30 years of experience in to a handful of key learnings. “Tony, you’ve just about experienced it all. You’ve seen the ups and the downs, you’ve watched companies come and go, you know what works and what doesn’t – narrowing all that experience down, what are the top 5 insights you could share with people” Not an easy task (liken it to having to choose between your children), but these are the ones that I settled on. I know there'll be something of value here for you. 1. Money Isn't EverythingThis is an interesting one. I've had many discussions with outwardly “successful” people who suffer terrible guilt and regrets about their personal lives. For some, the recognition that accompanies a position at the top (or earning more, or having more stuff), becomes the most meaningful dimension of their lives. Their life anchors are their identification with money, success, achievement, influence or power and constant affirmation of their importance as individuals. With retirement, all these anchors disappear. The destabilising effect is often made worse by a realisation of what has been lost, or sacrificed, years earlier, on the way up to the top: a truly fulfilling personal life; a good relationship with a spouse, children, and friends; and time to develop outside contacts and interests. No amount of money can bring that back. KEY THOUGHT - Balance in life is key, and at some point, you may need to decide what is more important to you. Choose wisely. 2. More Income And Financial Success Don’t Go Hand In HandAbout the most effective thing you can do to get ahead is so basic, I’m almost embarrassed to say it – spend less than you earn and do something sensible with the difference. I have financially comfortable clients who have never earned more than the basic wage and, at the same time, I know people who have enjoyed enormous incomes during their working lives, yet have retired virtually broke. The basic difference between the two is simple - one lot spent everything they had, the others saved a bit. It brings home just how managing your income and expenses is the absolute foundation of wealth creation. Yet so few people do this successfully. Spending is a lot more fun than saving. Even people earning very good money never seem to have any. That’s because they, like all of us, tend to spend about 10% more than they earn, no matter what their income levels. I have some very well-paid clients who say the solution to their troubles is to earn more. That’s wrong. Chances are they will overspend any increased income they receive too. In fact, some people who know they will be receiving a pay rise in December start spending more in July, just to get used to the feeling! KEY THOUGHT - It's not what you earn, but what you keep that counts 3. Never Make A Killing, Never Get KilledThere’s little I’m certain of, but these things are true: Investment cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on assuming today’s events will continue into the foreseeable future. It’s very difficult to convince yourself that; a) The good times will eventually end OR b) The bad times won’t last forever. What this means is that we tend to panic when prices go down and we are over ambitious after a run-up in price. My all-time favourite Behaviour Gap sketch by Carl Richards sums it up beautifully: The truth is no-one knows what will happen next in investment markets. Yes, some people do get lucky by making bets on certain stocks and sectors or getting in or out at the right time or correctly guessing movements in interest rates or currencies. But depending on luck is simply not a sustainable strategy. The alternative approach to investment may not sound as exciting, but is also a lot more reliable and a lot less work. It means reducing as far as possible the influence of fortune by taking a long-term and diversified approach. Understand too that risk and return are intimately linked. You don’t get high returns without bearing painful losses along the way. You cannot achieve perfect safety without accepting low returns. Believe it or not, you need to find that balancing point where you’ll never make a killing, because you won’t get killed there either. KEY THOUGHT – I have seen more wealth destroyed by a lack of diversification, than any other cause. 4. Markets Are Brutally EfficientNever forget that at the individual share level, markets are brutally efficient. Whenever you buy and sell an individual share, you are likely trading with someone who is smarter, more motivated and better informed than you are. You are as likely to win that game as you are of riding the next Tour de France. Most professional fund managers don’t fare any better. In fact, research shows that in some investment categories, less than 10% of professional fund managers actually beat their benchmark. So, what do you need to do to build long-term wealth? The key is to recognise the things you can’t control – the markets’ daily ups and downs and the daily noise from the media – and focus on the things you can:

KEY THOUGHT - Let the market work for you. Prices of securities in competitive financial markets represent the collective judgment of millions of investors based on current information. So, don’t try and outsmart it, work with it. 5. Keep A Lid On Costs And TaxesDay to day moves in the market are temporary, but costs are permanent. Over time, they can put a real dent in your wealth plans. That's why it makes sense to be mindful of fees and expenses. Costs might include purchase costs or redemption costs, which means that you might pay money either going into or coming out of an investment. In addition, many investment funds have ongoing expenses which are fees that come out of your investments. The fees feel invisible because you don't have to write a cheque for them. They're quietly deducted from your returns, but that doesn't make them any less real. KEY THOUGHT – $1 invested at 10% for $30 years is $22. That same $1 invested at 9% for 30 years is worth just $14. A 1% change in the return assumption has changed the result by 60%. Wow!! So, there you have it. What do you think? Don’t agree? What should be there instead? Topics that were close, but didn’t make the final 5 were:

Topics for another day. Whatever you choose to do when it comes to your money, the starting point must always be you and your needs, not what someone is trying to sell you. We run a fiercely independent advice business, free of ties or commissions and other incentives from product providers. Meaning we can provide balanced, objective advice without being influenced by compensation. This is not the normal business model, so it has been very gratifying to be recognised recently as a finalist in the FPA Excellence Awards in the CFP Professional of the Year Category. Do you want more like this?Building long-term wealth doesn’t have to be complicated. You don’t need a crystal ball. And you don’t need to knock yourself out trying to beat the market. Subscribe to our regular updates and we’ll share with you our best ideas on wealth management and retiring sooner. Important - This article and opinion is based on generally available information and is not intended to provide you with financial advice or consider your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage because of any reliance on this information. See full Terms and Conditions here.

Ben via Li

9/12/2016 08:58:50 am

"Investment cycles always prevail eventually" - one of the most commonly forgotten fundamentals. Great tips Tony!

Reply

Tony

9/12/2016 09:01:36 am

Thanks Ben, even property cyles

Reply

Jim via LI

9/12/2016 08:59:35 am

Great message Tony would have to agree and while not quite there yet-can't wait for the article on the cranky 65 year olds cheers

Reply

Tony

9/12/2016 09:02:17 am

Cheers Jim, I can't imagine you cranky :)

Reply

Michael via LI

9/12/2016 09:00:15 am

Great article Tony

Reply

Ed via LI

9/12/2016 09:00:50 am

Found this really useful, thanks for sharing!

Reply

Steve

9/12/2016 09:09:50 am

Congratulations on winning such a prestigious award as the CFP of the Year. Its awesome news and I am so proud of you. You are too modest. You are enjoying a great career and should be recognised for the contribution you have made. Well done again.

Reply

R

9/12/2016 09:11:58 am

I'll second that.

Reply

Adam

9/12/2016 09:14:13 am

Congratulations Tony. An outstanding achievement!. The good guys always eventuallu win

Vince

9/12/2016 09:16:25 am

Congratulations mate - just heard the news of the FPA award that is fantastic and very well deserved!! Great stuff! Cheers Tony and celebrate it well

Reply

PS

9/12/2016 09:18:21 am

A big congratulations on receiving your award. Greatness has been thrust upon you.

Reply

Bruce

9/12/2016 09:19:17 am

Great to hear you won the FPA Certified Financial Planner Professional of the Year (long enough?)

Reply

David

9/12/2016 09:24:11 am

Hey Tony - congrats on the win! Have had a few people come up to me singing your praises (including Fem) - a very deserving winner and champion of our profession !

Reply

Joseph

9/12/2016 09:24:42 am

Hi Tony, huge congrats on winning the FPA CFP Professional of the year 2016 award! Well deserved!

Reply

Lachy

12/12/2016 12:06:45 pm

Hi Tony,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

12/11/2016

17 Comments