|

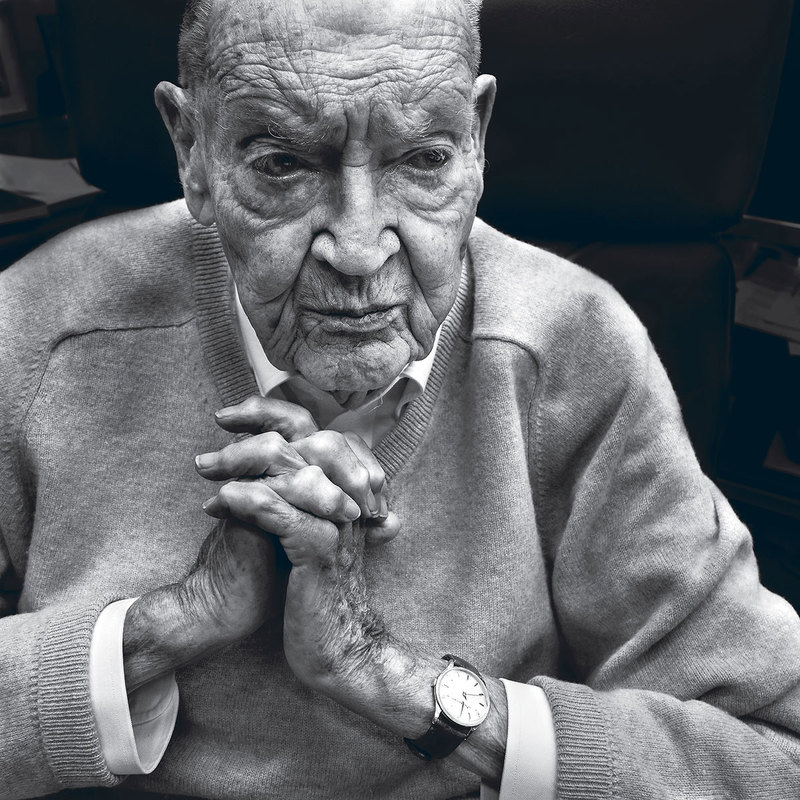

John Clifton "Jack" Bogle is an American investor and philanthropist. He is the founder and retired chief executive of The Vanguard Group. Vanguard is now one of the world’s largest fund managers and looks after about $4trillion of investments on behalf of clients. What's interesting, is that Vanguard is a mutual. That means no shareholders. All profits go back to investors. It’s a good model. I like it. Jack has just written an essay in the Financial Analysts Journal in which he condenses what he’s learned from 65 years in the investment industry. It’s pitched at financial nerds, and if that’s you, it's compulsory reading. If that’s not you, he still includes a seven-point plan for the average investor…. these are 7 gems from one of the investment greats. For regular readers of this blog, you will have heard all this before. Yet, there are still so many people out there who don’t have the basics in place. If you know anyone who’d benefit from Bogle’s wisdom, please share these tips with them. Take it away Jack. “Most of my books, essays, and speeches have focused on what I believe are the best interests of investors—the human beings whom we are all doing our best to serve. Perhaps this sampling of advice that I have offered over the years may be useful to other investment professionals. The entire article can be found here: Balancing Professional Values and Business Values Bogle's 1999 book Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor became a bestseller and is considered a classic within the investment community. Important - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Mike

31/5/2017 10:28:48 am

Het Tony, Mike here. Can you explain reversion to mean please.

Reply

Tony

1/6/2017 07:57:53 am

Hi Mike, the mean is the average return. Mean reversion is the theory that returns eventually move back toward the average. For example, every year of consecutive above average returns just gets you closer to a correction that will bring that return back to average. Think Sydney property. It works the other way too. Every year of poor returns just gets you closer to the recovery that brings you back to the average. Think those poor years of the GFC on sharemarkets and the 8 year recovery since then. What he is saying is Investment cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on assuming today’s events will continue into the foreseeable future.

Reply

Tony

10/10/2018 02:23:18 pm

This ones worth repeating:

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

8/10/2018

3 Comments