07 5440 5794

|

Ask a farmer about average rainfall and he’s likely to react sceptically. Knowing how actual rainfall varies from year to year, farmers carefully manage their crops and irrigation. It’s a lesson many investors could learn as well, with published ‘average’ returns masking a wide range of possible outcomes.

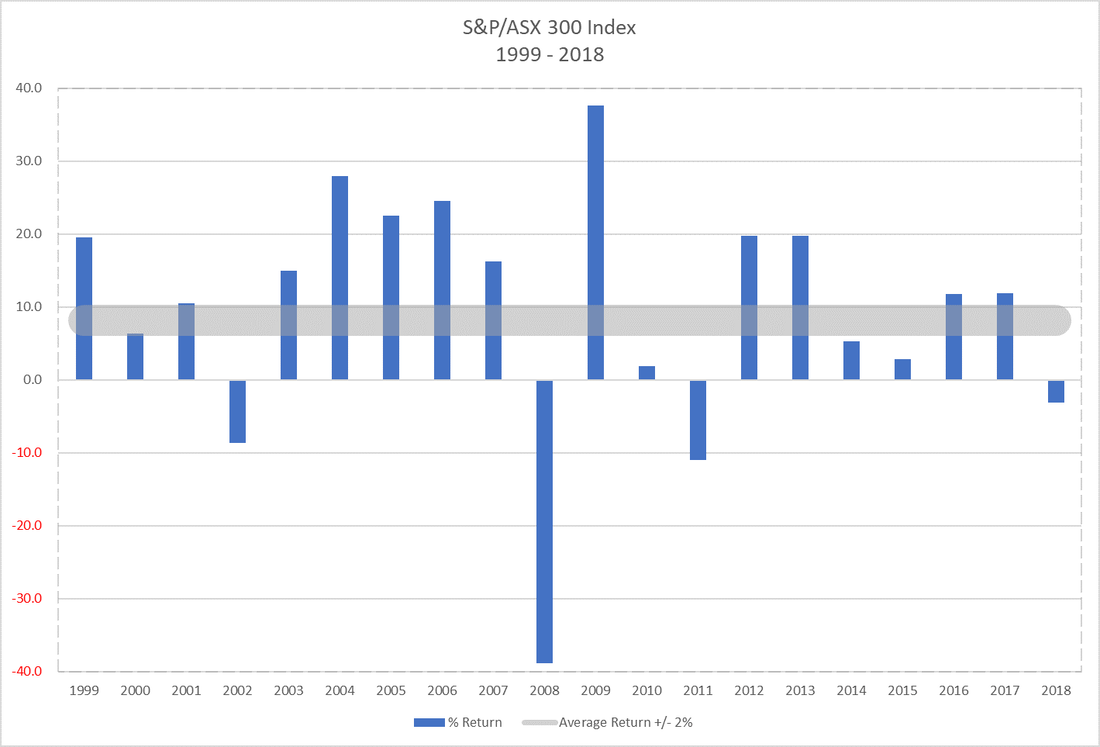

In the 20 years from 1999 to 2018, the Australian share market has produced an average return of 8.2% . So as a result of time and patience, $10,000 invested then would be worth around $48,000 now - I’d expect most people would be happy with that.

What is interesting is that when you break down the individual returns for each year, they almost never look like the average. Check out this graph below. There has been just one year in the last 20 (year 2000) where the return was within 2% of the average (so, less that 10.2% or more than 6.2%). It's been either feast or famine. Almost always, the returns is a long way north or a long way south of the average. And as you can see, falls are a regular thing. The price you pay for potentially better long term returns are the shenanigans along the way. The right portfolio for you is one that you can stick with through good times and bad.

A 20%, 30% (or even more) fall at some point is inevitable. It could be next month, next year or 5 years away. It's just a question of time.

You can deal with the ups and downs in two ways. Firstly, by taking a long–term view and remaining disciplined, you are more likely to experience that average return. Secondly, diversification is the best way of reducing the bumpiness of returns and of increasing the reliability of outcomes. Of course, this still doesn’t guarantee there won’t be investment droughts. Big falls don't feel great, but they are normal. Are you ready for that? If not, now would be the perfect time to discuss any concerns you have with your adviser.

Important - This information is shared with you purely for the purpose of financial education. It is based on generally available information and is not intended to provide you with specific financial advice or take into account your objectives, financial situation or needs. You should consider obtaining financial, tax or accounting advice on whether this information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here.

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

15/11/2019

0 Comments