|

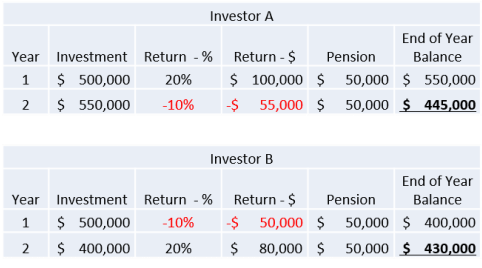

Retirement ought to be the time of your life. And for many retirees that holds true. Some would say that they were happily retired, while others wouldn’t even admit to being retired at all! That’s the point – this next phase of your life will be about living the kind of life that YOU decide. It might include work, it might be travel or it might be learning and doing new things! It is up to you. How can you make sure you follow this blissful pattern? In a previous blog, 5 Tips to a Happy Retirement, we focused on the non-financial aspects of a happy retirement – health, identity, friends and purpose. We showed that money won’t necessarily make you happy. What I’ve discovered though is that most people want to find out for themselves! So today, we look at the financial aspects of retirement, with a focus on the risks that are hardest felt by retirees. The great news is that all of these challenges can be reduced by optimising your financial nest egg with effective income and investment strategies, or by making the right lifestyle choices. Risk 1 – Your retirement fund earns less than you’d planned. An obvious one to start. The nature of compounding is, that a dollar invested at 9% for 30 years is worth $14. A dollar invested at 10% for 30 years is worth $22. That is 60% more. Lower than expected returns over a retirement of 30+ years can have a massive impact on your retirement nest egg. PRO-TIP The value of your retirement fund responds to 3 variables. The investment return, how much you draw as income and what fees are taken. Be conscious of all three at all times. Risk 2 - Rising prices Research shows that rising prices are retirees’ second biggest source of anxiety (after health). Deservedly so, in my opinion. The current forecast inflation rate is 2.5 per cent. Compounded for 30 years that equates to 209 per cent, or in simple terms, to maintain the spending power of your retirement income, a retired person will need to draw twice as much cash from their superannuation fund in 30 years’ time as they are today. 3 per cent compounded for 30 years is 242 per cent. 3.5 per cent compounded for 30 years is 280 per cent. Here’s another way to look at it. Let’s say you had a $500,000 retirement fund earning 7%. If you were drawing a pension of $50,000 per annum, your money would run out in the 20th year. Add 3% inflation to the annual pension, and it runs out in the 15th year. PRO-TIP There is no silver bullet here. Your best defence against inflation is higher returns. That will only ever happen if you accept higher risk and volatility. Know this equation but only ever invest in things you understand and are comfortable with. Ask us for independent financial advice if you are not certain. Risk 3 – Not honouring the rich ratio What Is The Rich Ratio? The Rich Ratio is an easy way to understand money. Simply put, it is the amount of income you have in relation to the amount of income you need. The maths is, “Have” divided by “Need” should be greater than 1. For example, if you have the ability to generate $10,000 a month and you need only $5,000, you have a rich ratio of 2 (10,000 divided by 5,000). You’re rich! By that same logic, if you have the ability to generate $1 million a month, but you need $2 million, you have a rich ratio of 0.5. You’re not rich. So it’s a very personal thing. Any ratio over 1 is fantastic. PRO-TIP Live within your means. More on the rich ratio here. Risk 4 – The timing of returns is not favourable. You might not think it matters what order the market tosses up it’s good years or it's bad. You’d be wrong. Here is a very simple example to explain why. Retiree A and Retiree B are identical in that they have the same investment dollars, they draw the same income and their investment earnings are the same - positive 20% one year and minus 10% in the other year. The only difference is that the order of those returns is reversed. Check out the difference in balances at the end of two years. While the average return is the same, the results are quite different. It was this timing of returns that proved so devastating to many new retirees during the GFC. PRO-TIP Segmenting assets within your retirement fund can reduce the impact of unfavourable timing. Contact us to see how this can work for you. Risk 5 – Unplanned Expenses Unexpected expenses can throw even the best laid plans in to a spin. PRO-TIP Have a buffer, specifically for emergencies. Risk 6 – The rules change They say the only certainties are death and taxes. I think you can add change to that. Our Federal and State Governments currently don’t honour the rich ratio and that can only continue for so long. Expect significant changes to retirement income policy and taxation over the next few years. PRO-TIP Review your situation regularly as the smartest option today may not always be that in the future. Contact us if you believe you should review your current circumstances. Risk 7 – Living longer than your money We Aussies are successful at most things, including the most important thing of all – staying alive! It is estimated that in 40 years’ time, life expectancy will be 95+ for men and 96+ for woman. Two million of us will be aged over 85. 40,000 of us will be over 100 - compared with 5,000 now and just 125 in 1975. Holy smoke, this really is the lucky country!! The downside of our expected longevity is that some, or maybe many of us, will run out of money. PRO-TIP – Putting in place strategies to minimise Risks 1 through 6 will mitigate Risk 7. More on the impact of longevity here. Risk 8 – The ability to run your own affairs. You won’t see it in television ads about retirement. You probably won’t read much about it in newspapers or even personal finance magazines. And yet one of the biggest threats you face to your financial security in retirement may be the drop-off in your own cognitive abaility to manage your investments as you age. This can leave you vulnerable. PRO-TIP I know this is something most of us don’t want to think about, but everyone needs a plan. You should have three key documents: A last will and testament, a power of attorney and an advanced healthcare directive. More on Estate Planning Here Whenever you're ready....here are a three ways I can help you get on track to a stress-free retirement. 1. Follow us on Facebook and Twitter and sign up to our regular emails updates. They are great places for great ideas. 2. Complete your Financial Readiness quiz It can be hard to know if you’re doing well with your money or not, so we’ve taken the guesswork out of it for you. Take our quick quiz and work out if you’re doing all the right things with your money or need to pull your socks up, as well get some ideas about what you should be doing next. 3. Work directly with me. If you’d like to work with me and my team to move from stressed and frustrated to relaxed and on track, you can schedule a phone call here. You’ll find out how we can help and if we are the right fit for you. 20 minutes, no obligation. Important This information is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each individual and investor are different and you should not act on this information without speaking to a financial, tax or legal adviser, who can consider if the financial product and strategies are appropriate for you. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. See full Terms and Conditions here. Note that changes in variables such as interest rates and rates of return may result in different outcomes.

Tracie

10/11/2015 09:05:25 pm

Really good article. What happens if you run out of money, will I get a pension?

Reply

Tony

11/11/2015 02:02:09 pm

Good question Tracie. Yes you would. And you don't need to run out of money completely. Couples can have over a million dollars in investments and still qualify for a part pension. The thresholds are here:

Reply

Kerry

10/11/2015 09:09:17 pm

Hi there, I don't understand why the balances would be different if the average return is the same (sorry). Can you explain more.

Reply

Tony

15/11/2015 07:39:45 am

Kerry, below is a link to a detailed explanation with examples.

Reply

Roy

10/11/2015 09:12:19 pm

Tony, when your super reaches maturity age, do you get a lump sum or a fort nightly payment. Do they tax you?

Reply

Tony

11/11/2015 05:24:30 pm

Roy, It annoys me when people say to me it depends, but it depends. Can you tell me which fund you are in? I can be more specific then.

Reply

Roy

14/11/2015 10:07:04 am

REST

Tony

27/11/2015 12:45:36 pm

Great news Roy, you can have either a lump sum or pension. Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed

16/7/2020

8 Comments